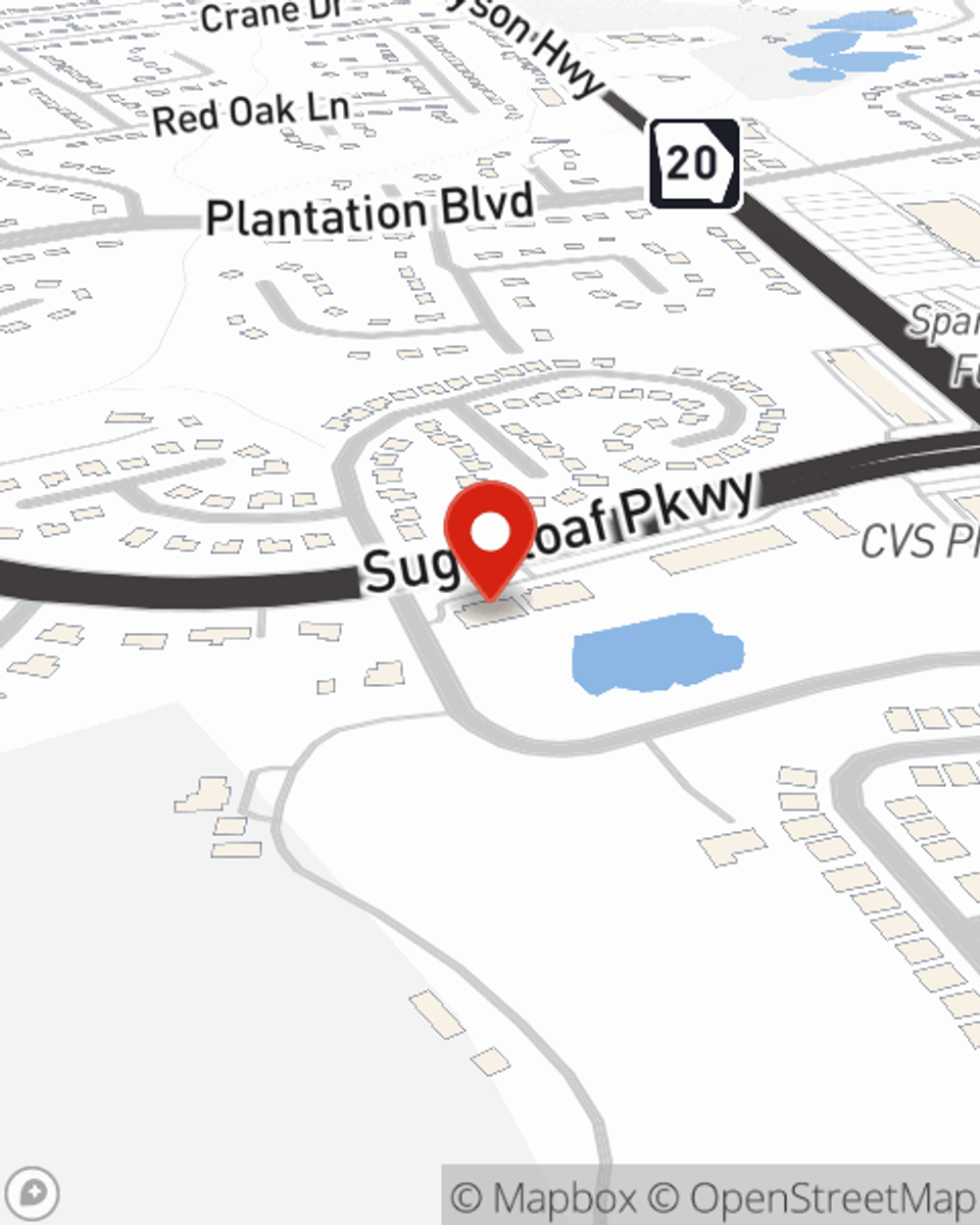

Business Insurance in and around Lawrenceville

Lawrenceville! Look no further for small business insurance.

This small business insurance is not risky

- Gwinnett County

- Hall County

- Barrow County

- Forsyth County

- Fulton County

- Loganville

- Grayson

- Gainesville

- Oakwood

- Dacula

- Bethlehem

- Auburn

- Braselton

- Buford

- Hoschton

- Duluth

- Suwanee

- Dawsonville

- Norcross

- Tucker

- Winder

- Cumming

- Flowery Branch

- Atlanta

State Farm Understands Small Businesses.

Running a small business is no joke. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, contractors, trades and more!

Lawrenceville! Look no further for small business insurance.

This small business insurance is not risky

Cover Your Business Assets

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Scott Stone. With an agent like Scott Stone, your coverage can include great options, such as worker’s compensation, commercial auto and business owners policies.

As a small business owner as well, agent Scott Stone understands that there is a lot on your plate. Reach out to Scott Stone today to talk over your options.

Simple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Scott Stone

State Farm® Insurance AgentSimple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.